I am very dissatisfied with Barclays of Delaware credit card. As a consumer and journalist take my advice and do not open any account with them since if your card or other authorized user’s card gets lost, stolen or cloned card while traveling which is the purpose of the card, you probably will never see a penny back from fraudulent charges, even if reported on time.

The company does not care if it violates the federal Fair Credit Billing Act! I only opened a credit card account with them several years ago since they used to fly from Fort Lauderdale to Mexico City and I would use JetBlue on a regular basis so at first it was a good deal.

As time passed, they no longer flew that route but I maintained the account since there was no foreign transaction fee and I could help my daughter as an authorized user get an extra card when she was going to be in Mexico.

As the major account holder of their credit card, a Barclays JetBlue World MasterCard, my daughter had an additional card which was either lost, stolen, or cloned, in Mexico City almost two years ago and Barclays never investigated my complaint properly as per my claims. The additional card I gave my daughter was reported as lost, stolen or cloned as soon as I was alarmed by my computer of fraudulent activity the morning of Sept 3, 2021, the same day I saw on my account online huge “temporary transactions” on my daughter’s additional card. During my initial call, Barclays agreed to cancel her card and not charge for the unauthorized charges, however several months later, Barclays reinstated them which were very many that totaled over US $3000.

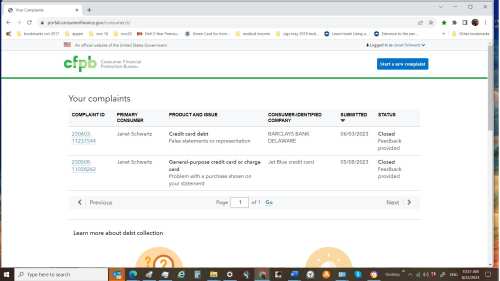

I launched an official complaint to the CFPB in May, 2023, understanding that they expect companies to provide complete, and accurate responses to consumer complaints, and responses tailored to the issues described in each consumer’s complaint, yet in this original complaint against Barclays JetBlue World MasterCard being either lost, stolen, or cloned, Barclays response for their investigation they allegedly made, was in itself fraudulent, proven by and totally invented by their second CFPB response dated June 2, 2023, which is now a whole new invented and contradictory story.

Throughout Barclays FRAUD DEPARTMENT investigation, the company failed to properly manage, respond correctly nor in a timely fashion, to my credit card dispute and fraud claim, as per federal law, and continued to post their debt collection on my online credit card account. In their new letter dated June 2, 2023, they state that on Feb 7, 2023, I was advised to provide a “full police report to continue the fraud claim.”

Let it be known that my daughter does not live in Mexico City, where the fraud took place and at first when she attempted to make a police report, the police said they were extremely backlogged due to Covid-19 and that the report would take a very long time. Over a year later the police informed her that she had to return to Mexico City to ratify the report in order to get a full copy, which in order for us to complete, would have cost more in time and money than the amount of the unauthorized fraudulent activity.

Early on the morning of Sept 3, 2021, I reported to Barclays by phone that these charges could NOT have been made by my daughter and also stated that the last time she said she used her card was at a restaurant called KYU, where they hang up women’s purses. It was not until later that same day she noticed her card was missing from her purse, and so she spoke to the manager of KYU who apologized profusely, including returning the money charged for her dinner there late the night before. When I reported the fraudulent activity on Sept. 3 to Barclays Fraud Department, I immediately had her card cancelled, thus I told her not to worry. Since I reported the unauthorized activity in a timely fashion the same day from the US while the transactions were still marked “temporary”” and cancelled her card, I was told by Barclays that the charges would be taken off. I understand that according to the Fair Credit Billing Act, at most I would be liable for is US $50.

Upon receiving Barclays latest response to the alleged fraud they made of their Fraud investigation, it states for questions to call Nevin, the Office of the President of Barclays, who I have been reaching out to by phone over a dozen times, however they never respond to my phone calls.

In the meanwhile we sent Barclays our own investigation which showed the largest fraudulent charges were from a company that receives small merchant charges called Sr. Pago, who finally emailed her the invoices, that clearly demonstrate that her signature was obviously falsified in many different fashions at many different places. I asked Barclays to even investigate if these are legitimate places and saw myself that many were closed the hours that Barclays and the invoices state her card was used. After having faxed Barclays all the paperwork of over 40 pages, we included copies of those invoices with her fake signature along with a copy of her US passport to show her real signature. At a later date when her passport expired, Barclays continued on insisting that we send them a copy of her new passport which we did for proof of her same real signature. Barclays just kept leading us on about their alleged continual investigation.

Apart from this Barclays sent numerous correspondences to my daughter using my card’s number which should have been addressed to me, the principal account holder. Some letters dated the same day were contradictory saying I or she was responsible for paying the debt and others that I or she was not responsible! I never open my daughter’s mail because it is against the US postal law and she was not back at our address in the US for some months to even read her postal mail. It is also totally unlawful that Barclays would provide the principal card holder’s last card digits in official letters addressed to my daughter, instead of to me the principal card holder.

Barclay has consistently made many errors of this sort since I reported the fraudulent activity on my daughter’s card including the sum of money being posted as temporary transactions and then when I reported the fraud they took them off and two months later returned an erroneous sum of the fraudulent purchases on my next statement. The total amount which I claimed fraudulent was $3,391.47 of which I continue to pay the minimum amount plus interest so as to not affect my very good credit rating. I expect Barclays to return this sum plus the interest accrued, as I understand that according to law, I phoned them immediately upon noticing the unauthorized transactions in a timely fashion.

I have since reported Barclays to the FDIC and the BBB and would like to end this nightmare so I do not have to proceed with a legal case nor another complaint with the State of Delaware Office of the State Bank Commissioner. So once again I phoned the Fraud Department last week to ask if they would please reopen the case and consider studying the falsified signatures. All they responded now is that my complaint was noted and they may answer me in another 30 days.

With all this it’s hard to fathom that Barclays keeps raising my credit limit due to my high credit scores and keeps sending me promotional materials non-stop.

Finally avoid all nightmares and do not get a Barclays Credit Card as they are the worst bank should you have any claims. I still hope the CFPB or the State of Delaware Office of the State Bank Commissioner can take whatever action necessary to implement the federal Fair Credit Billing Act on my behalf.

Sincerely, principal card holder.